When considering taking out a loan, understanding your Equated Monthly Installments (EMIs) is crucial. An EMI calculator can simplify this process, providing insights into how much you will repay every month. This article will delve into the EMI calculation for various types of loans, the factors affecting it, and how to effectively use an EMI calculator.

What is an EMI?

EMI, or Equated Monthly Installment, is the fixed amount that a borrower pays to the lender every month until the loan is fully repaid. The EMI amount depends on:

- Loan Amount (Principal): The total amount borrowed.

- Interest Rate: The cost of borrowing, expressed as a percentage.

- Tenure: The duration over which the loan will be repaid.

Types of Loans Covered

- Home Loans

- Personal Loans

- Car Loans

- Gold Loans

- Business Loans

- Mortgage Loans

- Auto Loans

Each loan type comes with its own set of terms and conditions, impacting the EMI.

How is EMI Calculated?

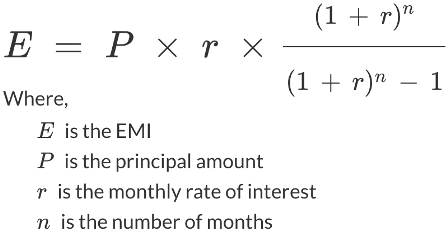

Standard EMI Formula

The standard formula used to calculate EMI is:

Explanation of the Formula

- Principal (P): The initial amount borrowed.

- Monthly Interest Rate (r): The annual interest rate divided by 12. For example, if the annual rate is 12%, the monthly rate would be 1212×100=0.0112×10012=0.01.

- Tenure (n): The total number of months over which the loan will be repaid. For a 5-year loan, n would be 60.

Example Calculation

Let’s say you take out a home loan of ₹30,00,000 at an interest rate of 8% for a tenure of 20 years (240 months).

- Convert interest rate:

- Monthly interest rate (r) = 812×100=0.0066712×1008=0.00667

- Substitute values into the formula:

- EMI=30,00,000×0.00667×(1+0.00667)240(1+0.00667)240−1EMI=(1+0.00667)240−130,00,000×0.00667×(1+0.00667)240

- Calculate EMI:

- After calculating, you find that your EMI is approximately ₹25,155.

Factors Affecting EMI

Several factors influence the EMI amount, and understanding these can help you in planning your finances better.

1. Principal Amount

- Definition: The total amount borrowed.

- Impact: Higher principal amounts lead to higher EMIs.

- Example: If you increase your loan amount from ₹20,00,000 to ₹30,00,000, your EMI will increase accordingly.

2. Interest Rate

- Definition: The percentage charged by the lender on the borrowed amount.

- Impact: A higher interest rate significantly increases the EMI.

- Example:

- At 8% for 20 years, the EMI for ₹30,00,000 is ₹25,155.

- At 10%, the EMI rises to approximately ₹29,000.

3. Tenure

- Definition: The period over which the loan is repaid.

- Impact: A longer tenure reduces the EMI but increases the total interest paid.

- Example:

- For ₹30,00,000 at 8% interest:

- 15 years: EMI is around ₹28,000

- 20 years: EMI is approximately ₹25,155

- For ₹30,00,000 at 8% interest:

Summary of Factors

| Factor | Impact on EMI |

|---|---|

| Principal | Higher principal = higher EMI |

| Interest Rate | Higher rate = significantly higher EMI |

| Tenure | Longer tenure = lower EMI, but more interest overall |

Step-by-Step Guide to Using an EMI Calculator

Using an EMI calculator is straightforward. Here’s how to do it:

- Select Loan Type: Choose from options like home loan EMI calculator, personal loan EMI calculator, car loan EMI calculator, etc.

- Enter Principal Amount: Input the amount you wish to borrow.

- Input Interest Rate: Enter the annual interest rate.

- Set Tenure: Specify the loan tenure in months or years.

- Calculate: Click on the calculate button to see your monthly EMI.

- Analyze Results: Review the EMI amount along with other details like total interest payable and total payment.

Benefits of Using an Online EMI Calculator

1. Saves Time

- Quickly calculates EMIs without manual computations.

2. Easy to Use

- User-friendly interfaces make it accessible even for those not financially savvy.

3. Comparison Tool

- Compare different loan options by altering principal, interest rates, and tenures.

4. Plan Finances

- Helps in budgeting and financial planning by knowing exact monthly outgoings.

5. Multiple Loan Types

- Use for various loans: home, personal, car, gold, business, mortgage, and auto loans.

Special Considerations for EMI Calculators

1. Accuracy of Inputs

- Ensure accurate input of interest rates and principal for reliable results.

2. Prepayment Penalties

- Some loans may have penalties for early repayment, affecting total costs.

3. Changing Interest Rates

- In case of floating interest rates, EMIs may change over time, requiring recalculation.

4. Loan Processing Fees

- Consider additional costs like processing fees, which can affect the total loan amount.

Calculate Your EMI Now!

Conclusion

An EMI calculator is a powerful tool for loan seekers, helping them understand and manage their financial commitments effectively. By considering the principal, interest rates, and tenure, borrowers can make informed decisions about their loans. Whether you’re using a home loan EMI calculator, personal loan EMI calculator, or any other type, the insights gained can significantly impact your financial health.

Remember to use the calculator wisely, considering all factors, including prepayment penalties and changing interest rates. With this knowledge, you can approach your loan journey with confidence.